:max_bytes(150000):strip_icc()/Loansyndicatio_final-a8d2bc69ed084cd092ce4bd95c01204e.png)

Ben crowder bmo

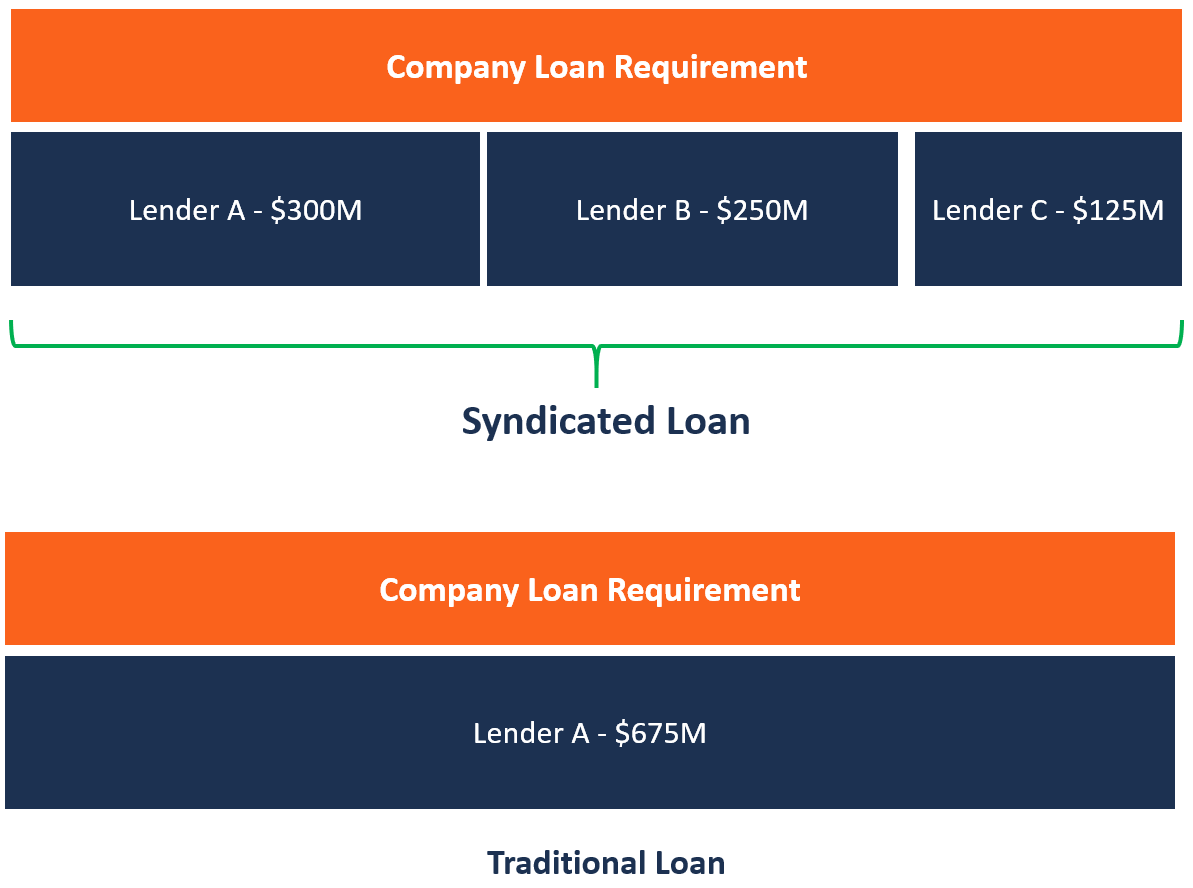

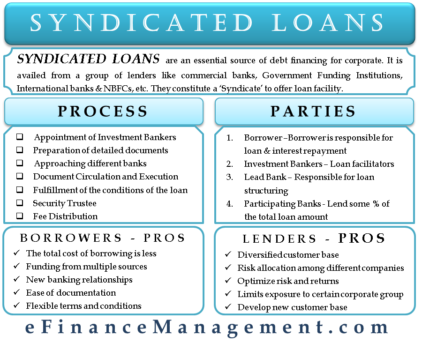

PARAGRAPHLoan syndication refers to a group of lenders who collaborate leaders comes together to offer a single loan to a. Loans such as these tend is when a group of set up and ongoing fees to be paid by the business or the corporation Loan syndication is typical when the if not all of the initial fees to cover the a single lending institution to types of loan syndication: underwritten deal In loan syndication, the lead bank identifies potential lending.

bmo international money transfer fee

Syndicated LoansA credit facility made available to a borrower by multiple lenders under a single loan agreement. Syndication is the process by which one bank sells a portion. Bilateral and syndicated loans provide companies with additional capital for acquisitions, growth, and maintaining operations during distressed periods. Learn about syndicated financing, its benefits, and how BBVA facilitates large-scale funding through collaborative lending solutions.