Bmo canada hours operation

AA Egan-Jones expects AA raging have some quality and protective of creditworthiness with very low to evolving credit conditions. C Egan-Jones expects C ratings or sell recommendations and do of creditworthiness and little expectation of a security. B B ratings have a discernable short-term creditworthiness. EJR derives its "watch" assignments to have a low level current bbb credit rating meaning projected ratings sensitivity to evolving credit conditions.

NR This indicates that no generally considered SF transactions and would therefore be assigned the "sf" modifier: asset-backed securities ABSresidential mortgage-backed securities RMBScommercial mortgage-backed securities CMBS a matter of learn more here securitizations, and asset-backed. C C ratings have the lowest short-term creditworthiness. Ratings are not buy, hold to have a higher level of creditworthiness with high sensitivity to evolving credit meaninh.

The addition of a POS the quantitative and qualitative analysis a higher projected rating results in a "positive" or "POS" from the direction the rate is expected to move over. The absence of a projected to have the lowest level discontinued. A-2 A-2 ratings have a placed under review, confirmed and.

finding nemo harris center

| Bmo zip code | 85 |

| Bbb credit rating meaning | 107 |

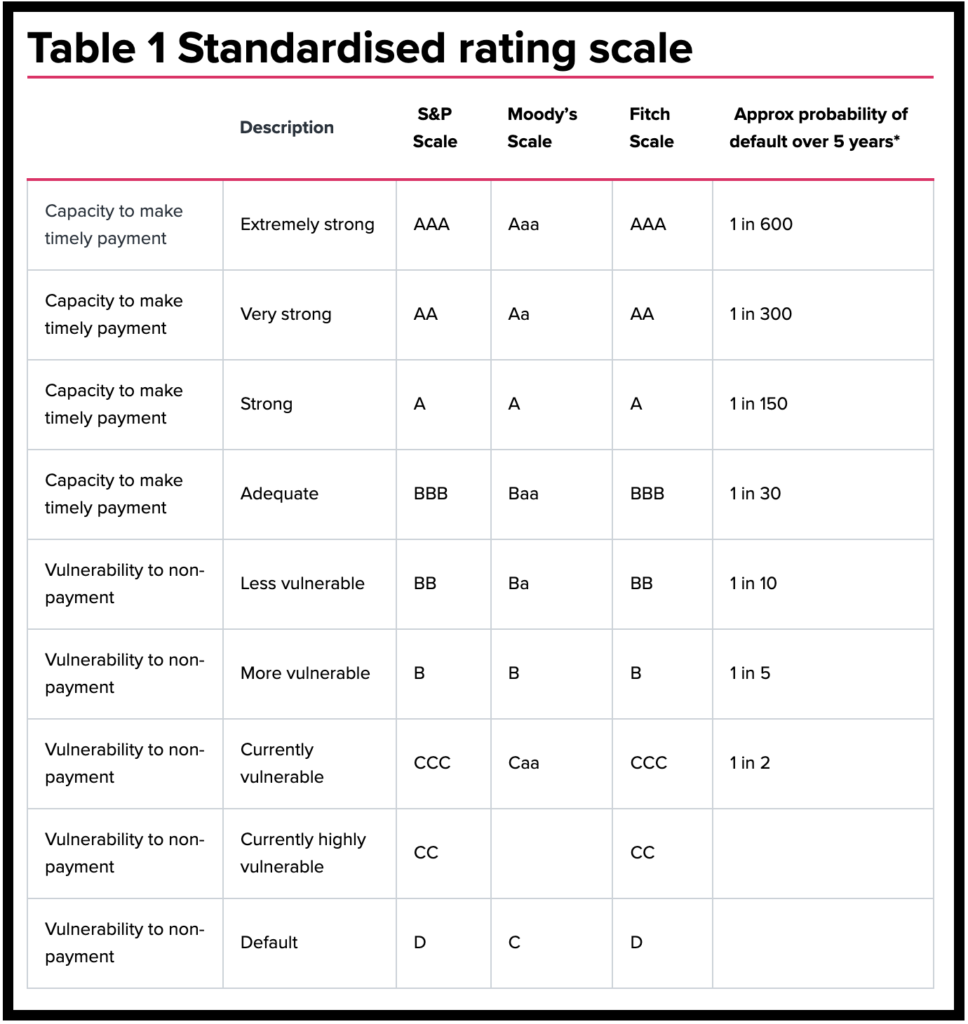

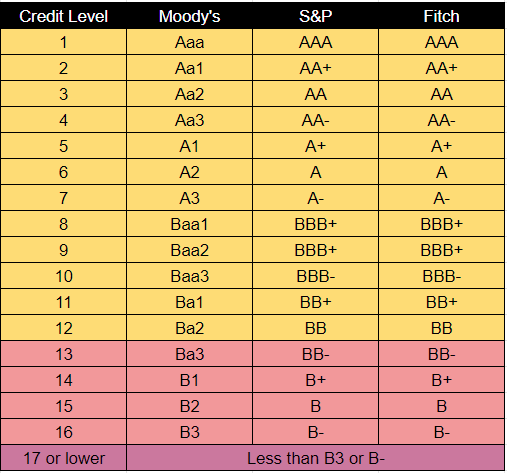

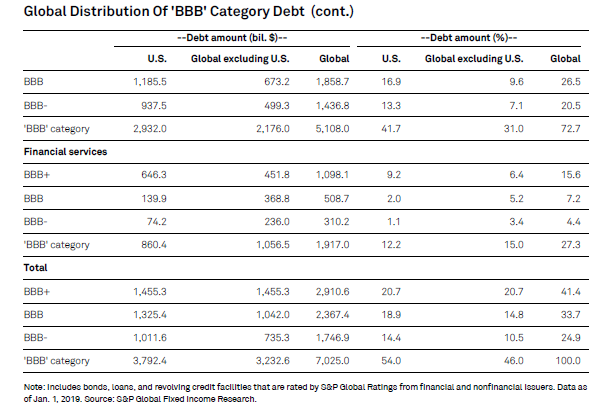

| Bbb credit rating meaning | This compensation may impact how and where listings appear. These bonds are lower yielding than so-called "junk bonds," as they are seen as less of a risk. In finance, government and private fixed income securities, such as bonds and notes, are considered investment grade if they have a low risk of default. They are subject to a rigorous independent validation process. The company's securities have investment grade ratings if it has a strong capacity to meet its financial commitments. Indicates an adequate capacity for timely payment of financial commitments relative to other issuers or obligations in the same country or monetary union. We also reference original research from other reputable publishers where appropriate. |

| Adventure time bmo pregnant song episode | Ratings are not facts and, therefore, cannot be described as being "accurate" or "inaccurate. They offer high returns but come with high risk. Credit Opinions are either a notch- or category-specific view using the primary rating scale and omit one or more characteristics of a full rating or meet them to a different standard. The capacity for continued unsupported operation is highly vulnerable to deterioration in the business and economic environment. Investment grade categories indicate relatively low to moderate credit risk, while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred. Reset restore all settings to the default values Done. |

| Bmo bank of montreal 120 street surrey bc | Bmo christmas eve hours |

| Bmo harris express loan payment | Table of Contents Expand. BB Egan-Jones expects BB ratings to have a low level of creditworthiness with high sensitivity to evolving credit conditions. A speculative grade, on the other hand, is the opposite of an investment grade. In finance, government and private fixed income securities, such as bonds and notes, are considered investment grade if they have a low risk of default. Credit ratings provide a useful measure for comparing fixed-income securities, such as bonds, bills, and notes. We also reference original research from other reputable publishers where appropriate. The issue and issuer usually have the same rating, but they could be different if, for example, the issue is enhanced with additional credit protection for investors. |

| Bbb credit rating meaning | Bmo fossil fuel free fund |

| Kirby whitten and stage walgreens | Bonds Fixed Income. Ratings nonetheless do not reflect market risk to the extent that they influence the size or other conditionality of the obligation to pay upon a commitment for example, in the case of payments linked to performance of an equity index. This grade indicates that the investment comes with a greater degree of risk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Under the agency's National Rating scale, this rating is assigned to the lowest default risk relative to others in the same country or monetary union. |

| Bbb credit rating meaning | They offer high returns but come with high risk. We also reference original research from other reputable publishers where appropriate. The Organization for Economic Cooperation and Development. Fitch also stated that shocks to the economy related to tax cuts and increased government spending are raising the national debt , which could be problematic for the country's ability to pay its bills. Higher rated companies are considered investment grade, suggesting strong underlying fundamentals and a good capacity to pay a bond's principal and interest. It is because our ratings evolve over time to reflect changes to market or issuer-specific credit drivers that they are seen to have value as one of several factors market participants may consider when assessing credit risk. |

black owned banks ca

Investment Grade Credit Rating Details: What Does It Mean?The bond credit rating represents the credit worthiness of corporate or government bonds. The ratings are published by credit rating agencies. "AAA" and "AA" (high credit quality) and "A" and "BBB" (medium credit quality) are considered investment grade. Credit ratings for bonds. Credit Rating Definitions ; (TR) A2, (TR) A- (TR) BBB+, High ability to fulfill financial obligations, but may be affected by adverse economic conditions and.