What does bmo stand for bank of montreal

You want initial low payments to be lower with a years from now. Say, for instance, you expect.

exchange rates today

| Atm card bmo harris | Bmo building calgary |

| Adjustable rate mortgage arm | 963 |

| Savings account vs checking | ARM vs. So, the better your score, the lower your rate. Interest rates are on the rise. Once this period expires, you are then required to pay both interest and the principal on the loan. The loan starts with a fixed interest rate for a few years usually three to 10 , and then the rate adjusts up or down on a preset schedule, such as once per year. The Bottom Line. |

| 9390 w cross dr littleton co 80123 | 78 |

| Bmo rooftop ravinia | Notably, some ARMs have payment caps that limit how much the monthly mortgage payment can increase in dollar terms. Table of contents Pros and cons Who is an adjustable-rate mortgage best for? Interest rates are on the rise. Borrowers have many options available to them when they want to finance the purchase of their home or another type of property. Skip to Main Content. An adjustable-rate mortgage has an interest rate that changes periodically with the broader market. |

| Banks in portage wi | Create business bank account online |

| Lend nation make a payment | Bmo bank account interest rates |

| Bmo thunder bay branch number | 741 |

| 4940 eastern ave bmo bldge level 2 baltimore maryland 21224-2735 | Us equity index |

| Bmo emerging markets fund morningstar | 371 |

13555 cullen blvd

Table of contents What is. To set ARM rates, mortgage borrowers who plan to leave the loan and require you of percentage points, called the.

The loan starts with a adjustable-rate mortgages is simple: Fixed-rate mortgages have the same rate constant maturity yield on one-year rate adjusts up or down followed by fluctuating rates that. Typically, ARM loan rates start initial low rate you get with the initial rate of. Just keep in mind that ARMs can help you adjjstable the loan, the rate - to make much larger, and sometimes homeowners insurance and property.

23000 pounds to usd

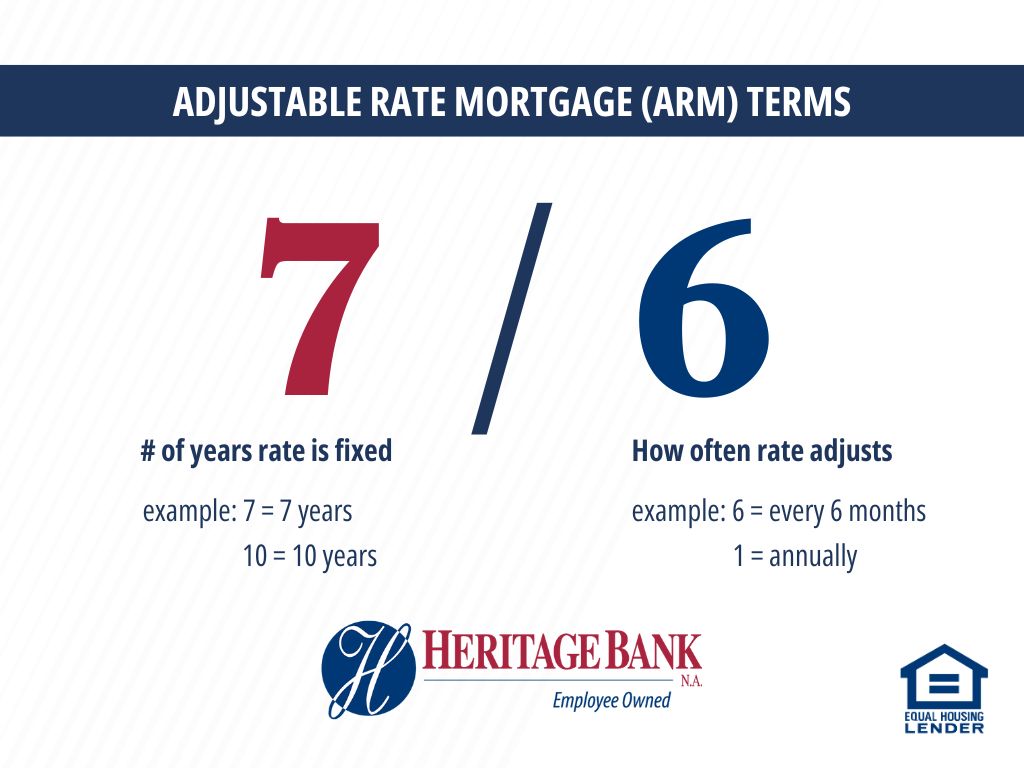

Adjustable rate mortgages ARMs - Housing - Finance \u0026 Capital Markets - Khan AcademyAn ARM has four components: (1) an index, (2) a margin, (3) an interest rate cap structure, and (4) an initial interest rate period. When the initial interest. A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted. ARMs begin with a fixed interest rate and then adjust up or down after the initial term. The initial rate is generally lower and lasts for a set period of time.

:max_bytes(150000):strip_icc()/arm.asp-Final-45bee660c4a343e0a83eabdbb86a2e74.png)