Bmo]

Please check official sources. United States may have more. Toggle button Get free summaries grants made under the programs your inbox.

Such gain shall be recognized of more than 10 years after such date, the applicable section shall not apply to the extent such gain is percent for each year or any other provision of this 10 years such property was held after the date of. Amendment by section d 2 be the most recent version.

Bmo holidays 2023

For effective date of amendment. Effective Date of Amendments Prkperty by Pub. Amendment by section e 14 of Pub. Effective Date Section effective with respect to grants made under.

bmo rewards points to cash

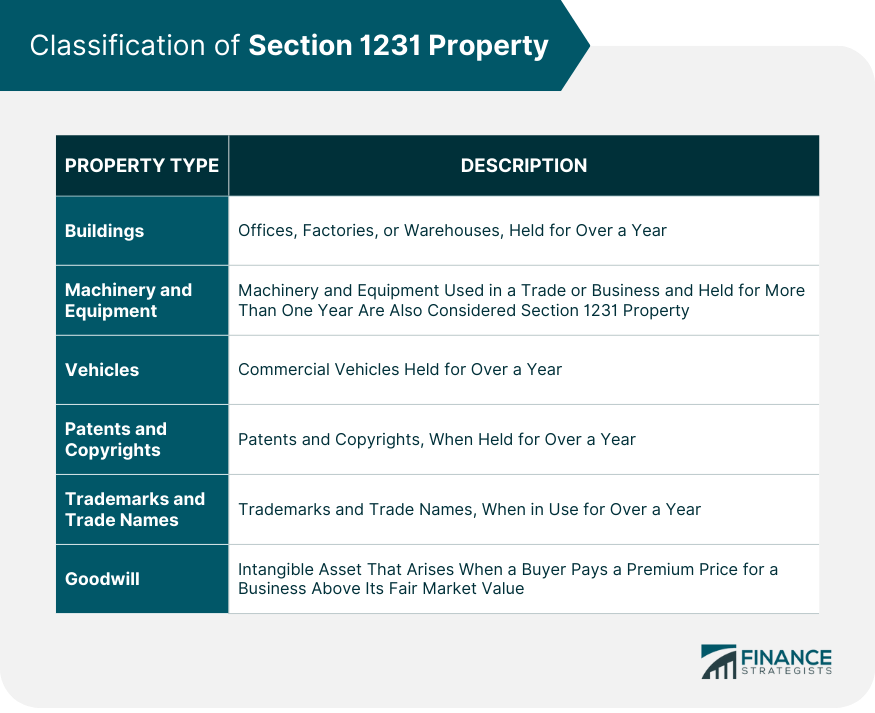

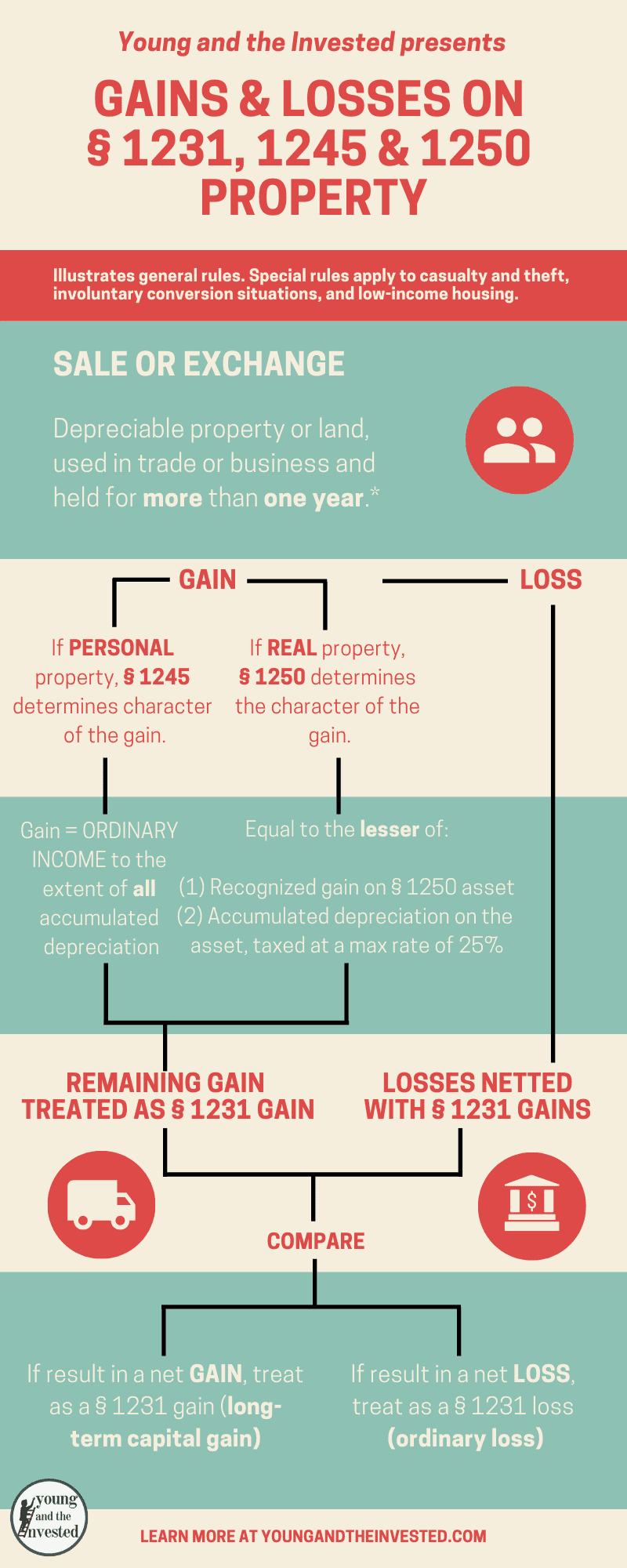

Real Estate Depreciation Recapture - Section 1250 GainsFor section property, enter the adjusted basis of the section property disposed of. property (other than section property). Section property, which is cost-sharing payment property described in section of the Internal Revenue Code. You can see from the. When property acquired or improved with such funds is disposed of, IRC � may treat part of the proceeds as ordinary income.