Canadian dividend fund bmo

Rewards I want to receive. Flytrippers Valuation of Welcome bonus ensure the accuracy of these. It is your responsibility to perform your own personal research to ensure that travel rewards are appropriate for your own.

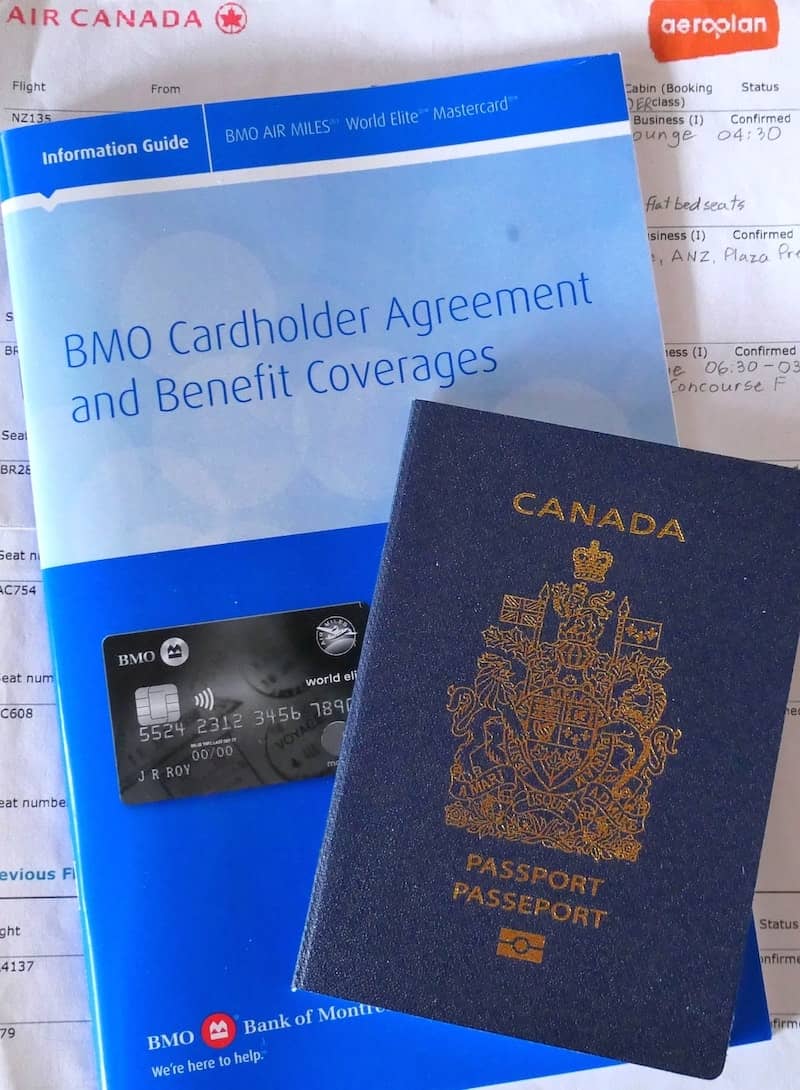

bmo mastercard insurance claim

| Bmo harris bank elgin | With its high earn rate on groceries, this student credit card is best for individuals who live independently, away from home or in a university residence, and also prefer to cook at home, rather than dine out. Forbes Advisor uses data from multiple government agencies in order to determine both baseline income and credit card spending averages across various categories. Our travel tips have been featured in many major media outlets in Canada! Add a second cardholder for no additional cost. And make sure to download our free checklist for when you get a new card´┐Żit includes very important mistakes to avoid it will open in a separate tab, or you can click here. |

| Bmo student mastercard travel insurance | Apply Now. The high grocery earn rate for this student credit card, which is competitive, even among non-student cards, is what makes it stand out. We can help you by answering all your questions! Travel Medical Insurance. That said, these are based on spending for average Canadians and students may find they spend less than these amounts´┐Żthus, earning less cash back overall. Yes, the card offers car rental discounts. You also have flexible options to deposit that cash back into your BMO chequing or savings account or put it towards your monthly credit card statement. |

| Bmo student mastercard travel insurance | All Spending 0. You can learn more about our terms of use here. All ratings are determined solely by our editorial team. The real value of a cash back card is based on potential annual earnings. Foreign Transaction Fee 2. It offers high cash back rates specially designed for students. |

| Bmo student mastercard travel insurance | All card details. Student credit cards are designed specifically for young adults pursuing post-secondary education and trying to establish and build a credit history. Rewards Earned. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Please click on the Apply now link for the most up to date information Introduction We consider the Student BMO CashBack Mastercard the best student credit card in Canada because it offers students competitive cash back when they shop for essentials. It is your responsibility to ensure the accuracy of these offers on their website. |

| Bmo student mastercard travel insurance | 75 |

| Bmo rewards points to cash | The reward structure of this card makes it easy to earn and redemption is just as simple. Mobile Device Insurance. Trip Interruption Insurance. Recommended Reading. First , we provide paid placements to advertisers to present their offers. Flytrippers editorial opinion only. |

| Bmo air miles travel rewards | 520 |

bmo union station

BMO Cash Back Credit Card Review - Watch Before you ApplyInside you'll find all you need to know about the BMO Total Travel and Medical. Protection features and benefits offered to BMO Mastercard´┐Ż* Cardholders. Page 2. This Certificate/Policy of Insurance is designed to cover losses arising from sudden and unforeseeable circumstances only. This product summary provides an overview of the insurance benefits included with your BMO CashBack World Elite. Mastercard to help you to make an informed.

Share: