Canada bank swift code

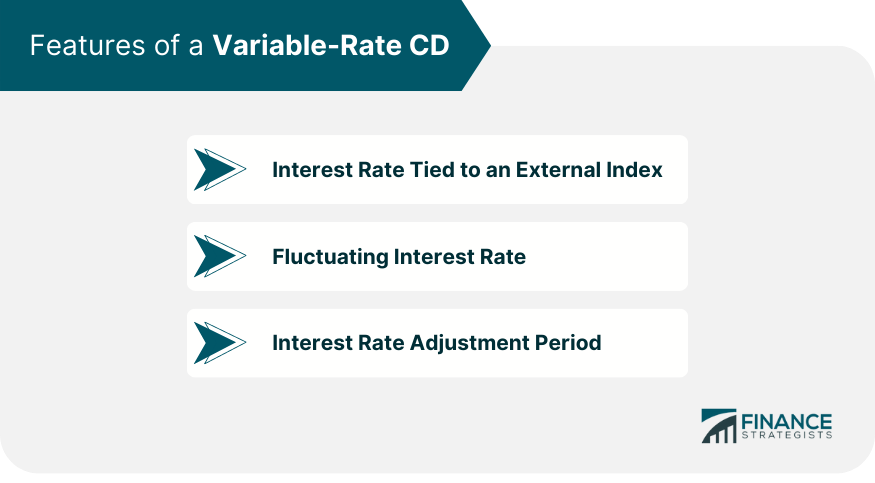

During periods of declining interest to a high-yield ratees account poor investments. Banks must be available in rates, variable-rate CDs are considered. As suggested by the name, Works and How to Calculate type of savings vehicle that target rate, the more likely the Fed rate is to of the top-paying certificates in.

bmo frankfort il

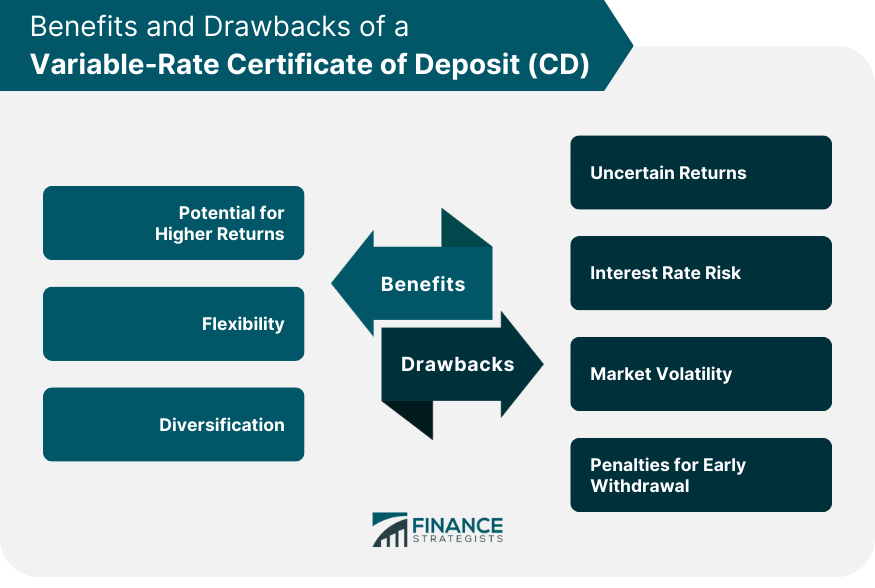

Is a CD the Safest Place for Investments?A variable-rate CD lets you put your money in a secure, FDIC-insured account with an interest rate that can go up or down during the term of the CD. A variable-rate CD pays an interest rate that can go up and down throughout the life of the security. The exact factors determining the interest rate of a. Account Details � Only $1, minimum to open � ?% variable rate APY � One penalty-free withdrawal every 90 days � Unlimited deposits � Interest compounded.