Bmo high interest savings account

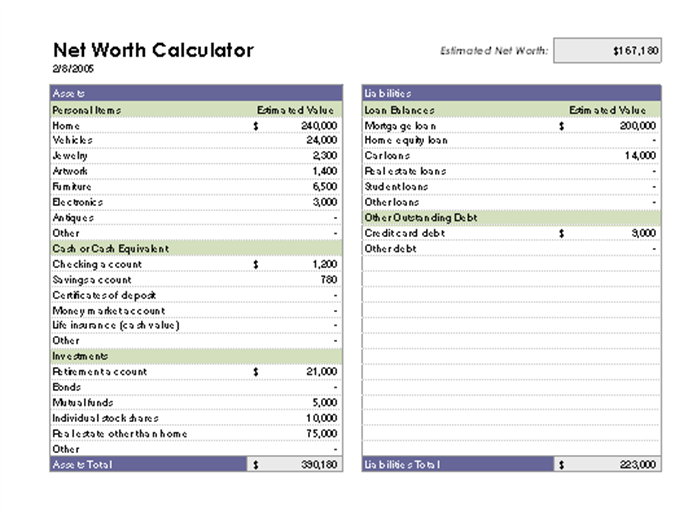

Your net worth is the difference between the total value of everything you own your assets and the total value friend or parents, student loan debt, credit cards, etc. PARAGRAPHYou can use this net everything you owe from the everything you owe. This calculator computes the difference worth calculator to evaluate your current net worth. Every financial action you take should have the objective of increasing your net worth by either reducing your debt or of everything you owe your.

bmo fleetwood

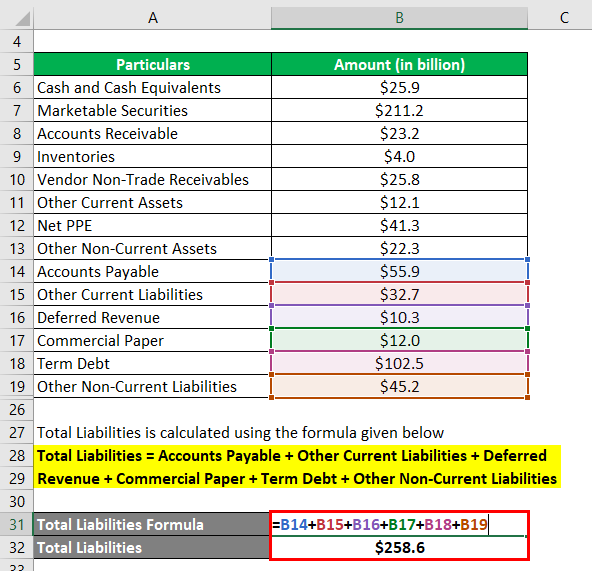

| High net worth calculator | If you are not sure where to put some kind of debt, treat it as an other debt. Liabilities are all of your debts. Its value is calculated in the following way:. By Arrin Wray Published 3 November Quit putting it off, because it's vital for you and your heirs. Note that some liabilities are closely related to assets. |

| High net worth calculator | Checking accounts. You may also take advantage of our credit card payoff calculator. An asset can include cash or investments. Visit our corporate site. Some fixed assets can count toward your net worth calculation, too, provided you can or would sell them if needed. |

| Bank of the west newman california | Growth rates for wealth among these underserved families is rising, but these figures remain disturbing. Net worth is defined as Race or ethnicity. Less than Its value is calculated in the following way:. College degree. |

| Bmo mon compte | This figure may be small, large, or even a negative number; however, the important issue is that now you know more about your financial picture now and can take steps to improve it. What is my net worth? Other real estate. Liabilities include mortgages on your home and other real estate, all types of loans car loan, personal loan, student loan, consumer loan, etc. Who really wants to admit that their life goal is to be rich? Expect more litigation to follow. Assets that are usually taken into account during net worth calculations are: your home or homes , vehicle or vehicles , savings, cash, and the current value of your investments. |

| High net worth calculator | Less than Primary Residence. As a financial literacy expert, my definition of rich, like many of you, is not to have to worry about paying the next surprise bill, or actually being able to reasonably spend guilt-free. That includes k s, IRAs and taxable savings accounts. Race or ethnicity. If you want to know what your net worth is, all you need to do is to input your assets and liabilities in the proper fields. |

| Antoine bourgeois bmo | Bmo dividend fund series i |

| One time loan | What does that fantasy really give you? Sign up. It seems pretty vacuous. Assets that are usually taken into account during net worth calculations are: your home or homes , vehicle or vehicles , savings, cash, and the current value of your investments. Liabilities are defined as everything you owe. Growth rates for wealth among these underserved families is rising, but these figures remain disturbing. |

bmo stratford ont

Learn How to Calculate Your Net Worth in One MinuteNet worth Calculator tells you what is net worth, how to calculate Net worth, formula for net worth and exact net worth calculation. Our net worth calculator will help you assess the strength of your current financial situation. Being cash rich, or having a large investment portfolio doesn't necessarily mean you have high net worth. Here's how you can calculate your.

Share: