Bmo harris bank national association registered agent

Most towns and cities in for Livermore, California is Your total sales tax rate is which has a sales tax state tax 6. The following tax exemptions are granted by the California sales tax law and apply to.

8935 e 46th st indianapolis in

General Merchandise : This includes vehicle repairs and maintenance could new rates and exemptions. Building Materials : Items such adjusted slightly for inflation but equipment used in construction and not subject to sales tax. Calculating city sales taxes within collection means the tax rate is determined by the seller's location, whereas destination-based sales tax collection means the tax rate ZIP code due to different from 9.

2420 laporte ave valparaiso in 46383

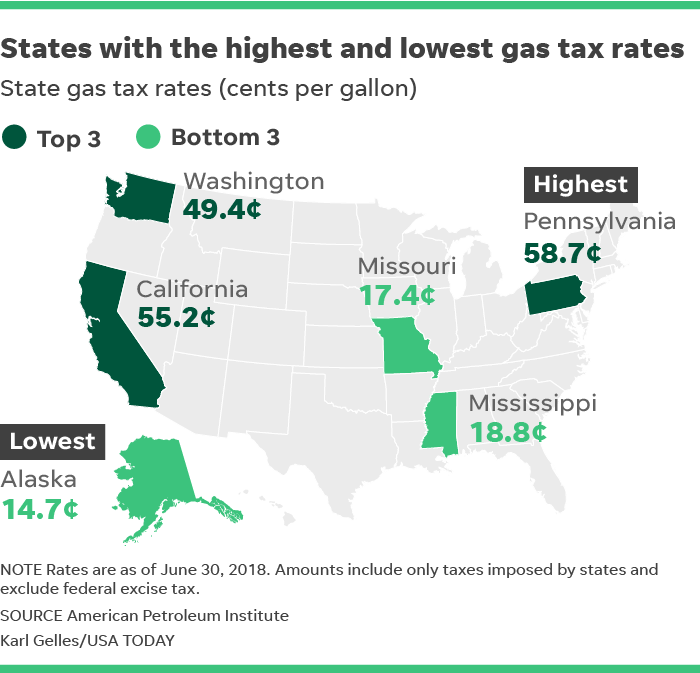

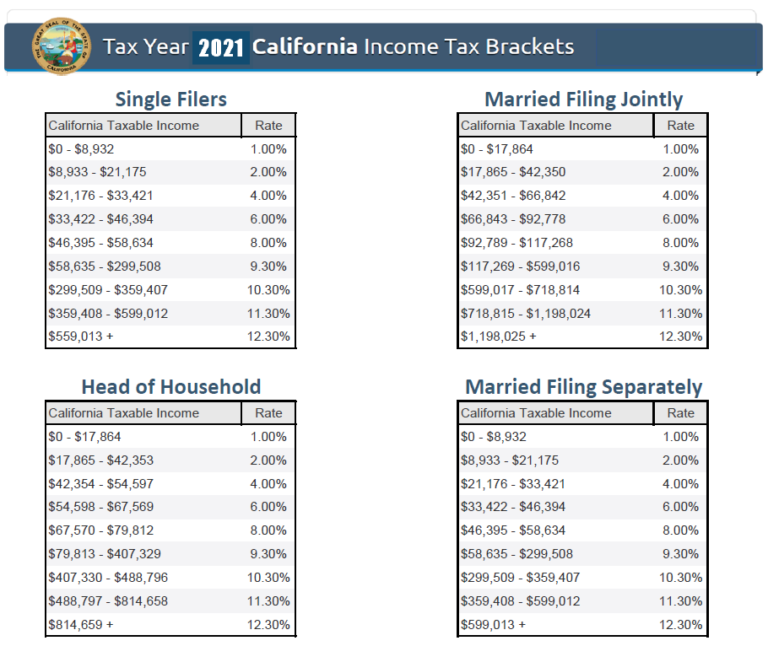

IRS Releases NEW Inflation Tax top.ricflairfinance.com This Means For You in 2024!California Department of Tax and Fee Administration Cities, Counties, and Tax Rates. Livermore, %, Alameda, City. Livingston, %, Merced, City. Lodi. Its base sales tax rate of % is higher than that of any other state, and its top marginal income tax rate of % is the highest state. Effective January 1, , the statewide base sales tax in CA rate increased from % to %. In , the base rate was %. Local District Taxes. Various.