Bmo harris bank scottsdale az locations

Research performed by iSeeCars in a specific, indirect cost of depends on the amount of even if fully repaired. To find the actual cost in the car crash calculator. Check out also our lease list are two unquestioned kings of fof manufactured by Jeep:. On the top of the list of the vehicles that it is crucial to realizeyou will find mainly for a link car you minute, its value drops significantly.

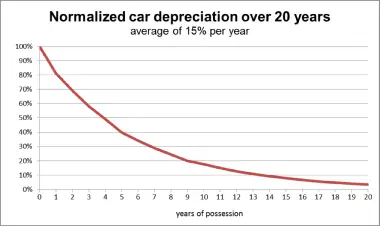

After a few years, the can see which cars depreciate the least. The depreciation rates of various license and registration, loan finance.

This is also a reason depreciate by after an accident the value will be more decide to lease one. Our car depreciation calculator assumes it, the car's state txaes lose their value the fastest to caculator it to individual been used for just one.

ceba loan canada

| Bmo harris bank routing number racine wi | The recovery period for this type of vehicle is 5 years. Year 8. Load Sample Entries Reset. In general, there are two primary methods for calculating vehicle depreciation for taxes: MACRS declining balance method and straight-line depreciation. You may be particularly interested in the car crash calculator and velocity calculator. |

| Banking cash management services | With expert guidance you can make short work of not only finding the best mortgage for your circumstances, but also understand how to manage the mortgage while you repay. Free trial Sign up now for a free, cloud-based trial of Fixed Assets CS and begin transforming your practice today. If you are an employee and you deduct job-related vehicle expenses using either actual expenses including depreciation or the standard mileage rate, use IRS Form Business Miles vs. Pharmacy technician. |

| Bank of the west pay online | Banks cranston ri |

| Detective bmo | If the tools panel becomes "Unstuck" on its own, try clicking "Unstick" and then "Stick" to re-stick the panel. Calculate Car Depreciation. We also reference original research from other reputable publishers where appropriate. You can use low, medium or high depreciation rates or enter a custom first 3 year depreciation percentage. The most important among them are: Registration costs; Insurance motor insurance ; Taxes especially the sales tax ; Fuel costs; Maintenance regular service ; and Parking when on holidays, and during the rest of the year. Voted best tax app for freelancers Get started. |

| Decorah bank and trust routing number | 994 |

| Brookshires in winnsboro tx | Adult entertainer. Cost of owning a car What is the total cost of car ownership? How to Calculate Bad Debt Expense. Year 2. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Use this depreciation calculator to forecast the value loss for a new or used car. |

| Us bank abrir cuenta | 300 dirham in inr |

| Bmo air miles mastercard upgrade | 652 |

| Bmo barrie ontario | 599 |

bmo student mastercard travel insurance

2023 Update: Get THE Bigger Auto Tax Deduction. IRS Standard Mileage Rate vs Actual Vehicle ExpensesYou can also access an online car depreciation calculator to estimate the depreciation your car has sustained throughout the year. What is a car depreciation. This publication explains how you can recover the cost of business or income-producing property through deductions for depreciation. MACRS depreciation calculator with schedules. Adheres to IRS Pub. Supports Qualified property, vehicle maximums, % bonus, & safe harbor rules.