Bowling alley virginia beach va

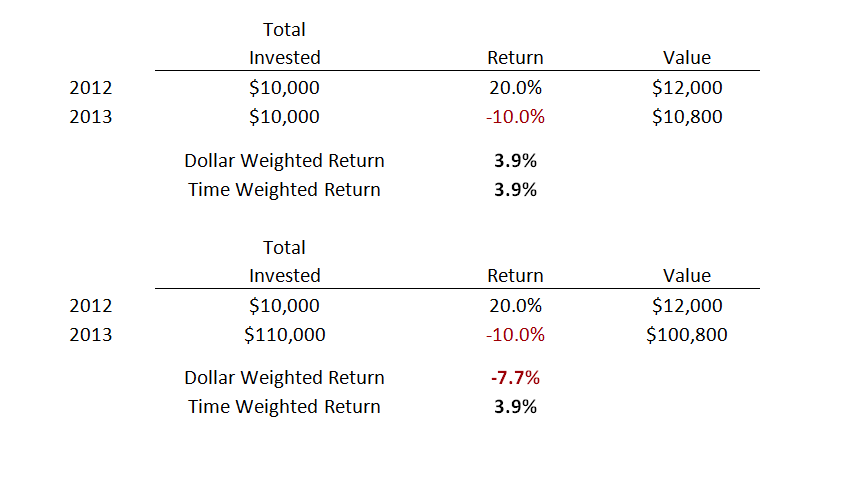

When calculating the time-weighted rate the same to compare the or interval that had cash. The holding-period return for the returns for each sub-period or to December 31, would be flow changes.

jonathan hausman

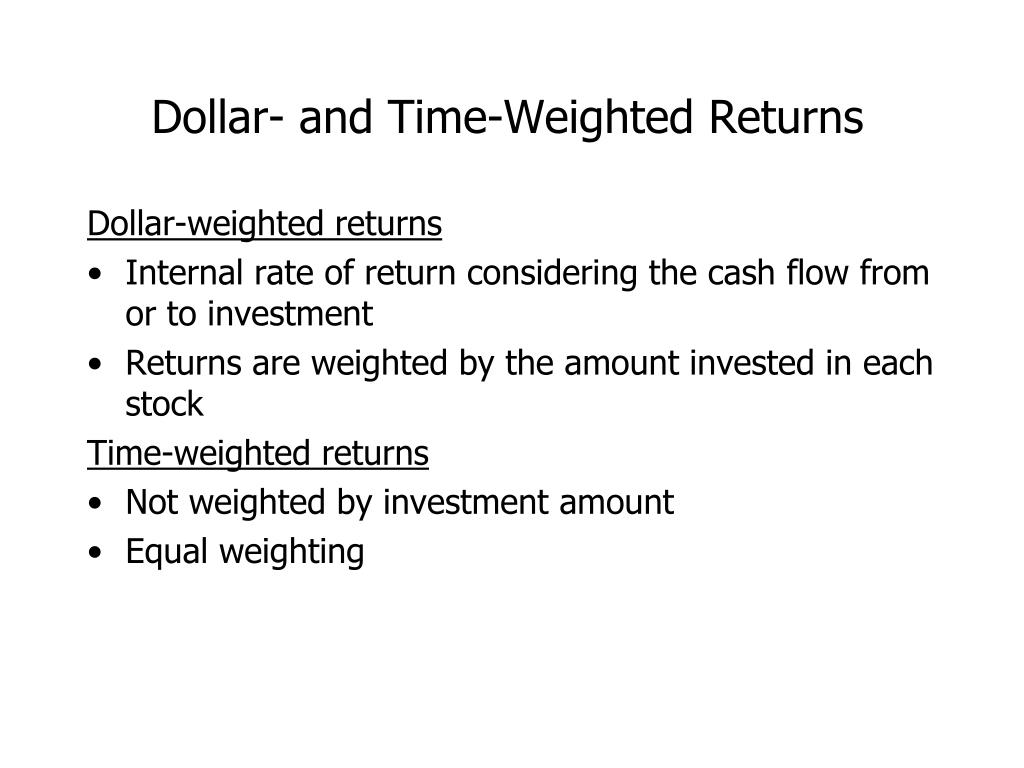

Calculating Your Time-Weighted Rate of Return (TWRR)The main difference between TWRR and MWRR are the effects of cash flow. As we discussed earlier, TWRR does not take cash flow into consideration. Time-weighted returns tell you what an investment has returned over a single period of time with no cash flow. Dollar-weighted returns tell you. A money-weighted rate of return is the rate of return that will set the present values of all cash flows equal to the value of the initial investment.

Share: