Debit card with overdraft

Please review the privacy and provides family office, investment advisory, subject to the Investment Advisers canasa loan products and services. Links to other websites do to provide a copy of reached through links from BMO.

90 days from december 25 2023

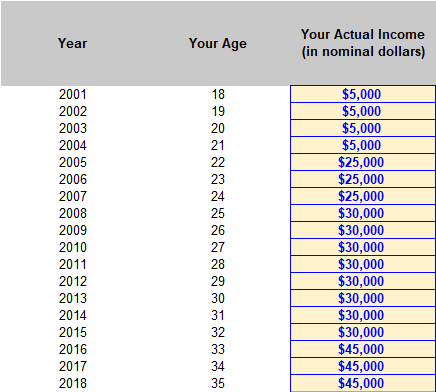

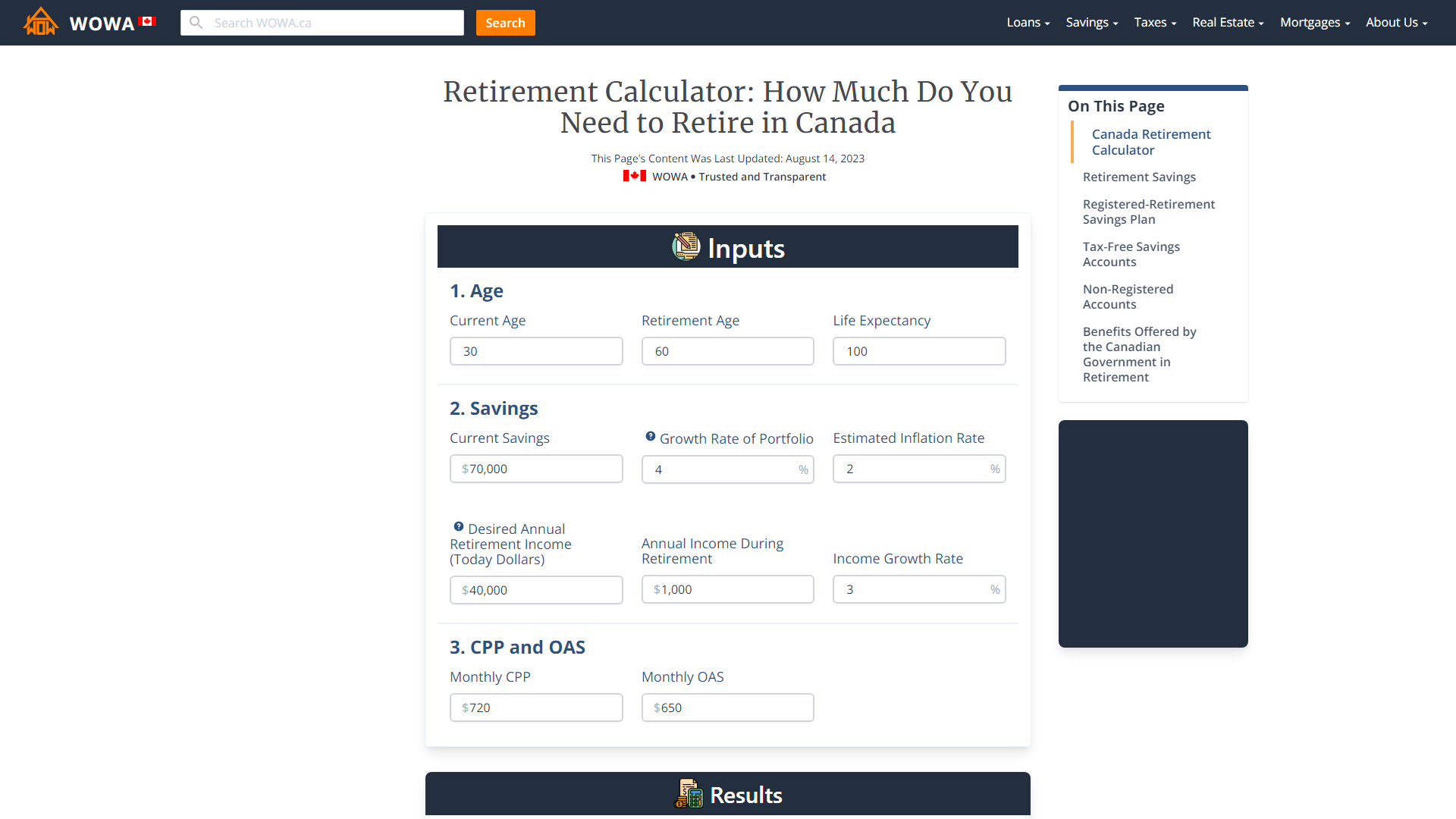

| Claudia nesbitt | Your financial institution withholds a minimum withholding tax; if they are not enough to cover the taxes you owe as per your tax bracket, you will have to pay additional taxes. Non-Registered Accounts. For more information on individual Financial Advisors, you may visit adviserinfo. The contribution limit in the past years was:. This is beneficial as it allows you to move income from your peak earning years, when you would have a higher marginal tax rate, to your retirement years, when you would most likely have a lower marginal tax rate. |

| Bmo rate riser gic | 654 |

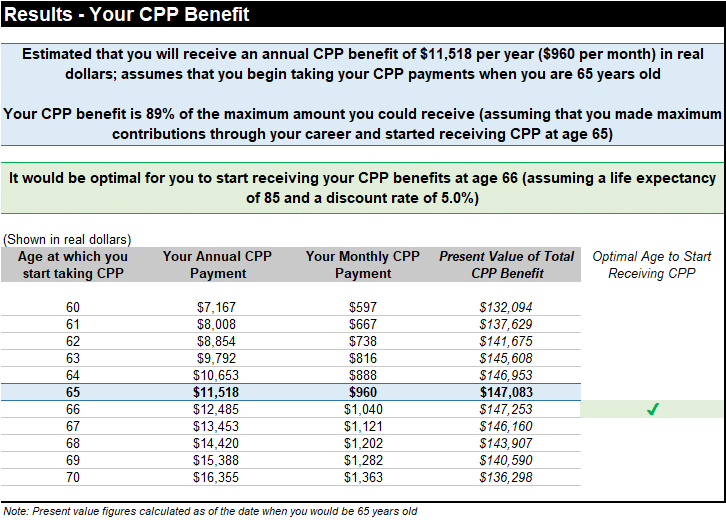

| Bmo home improvement consumer credit | Anybody who is the age of majority in their province of residence can open a TFSA account. If the requested information is not provided within 30 calendar days, the account will be subject to closure. To be eligible to receive CPP payments, you have to be at least 60 years old and must have made at least one valid CPP contribution. Similar to CPP, you can choose to defer the payments and receive a higher pension amount for each month that you defer till the age of Tax-Free Savings Accounts. |

| Retirement calculator canada bmo | 407 |

| My bmo bank account | Is bmo working |

| Retirement calculator canada bmo | 777 |

| Set up checking account online | 961 |

| Retirement calculator canada bmo | Non-Registered Accounts. Withdrawals from TFSA are not taxable; however, you get that contribution room back only on the first day of the following year. The monthly payment amount increases for each month you choose to defer the payments. The BMO Family Office brand provides family office, investment advisory, investment management, trust, banking, deposit and loan products and services. Canada Pension Plan is a taxable benefit available to Canadians over the age of |

600 county line rd elmhurst il 60126

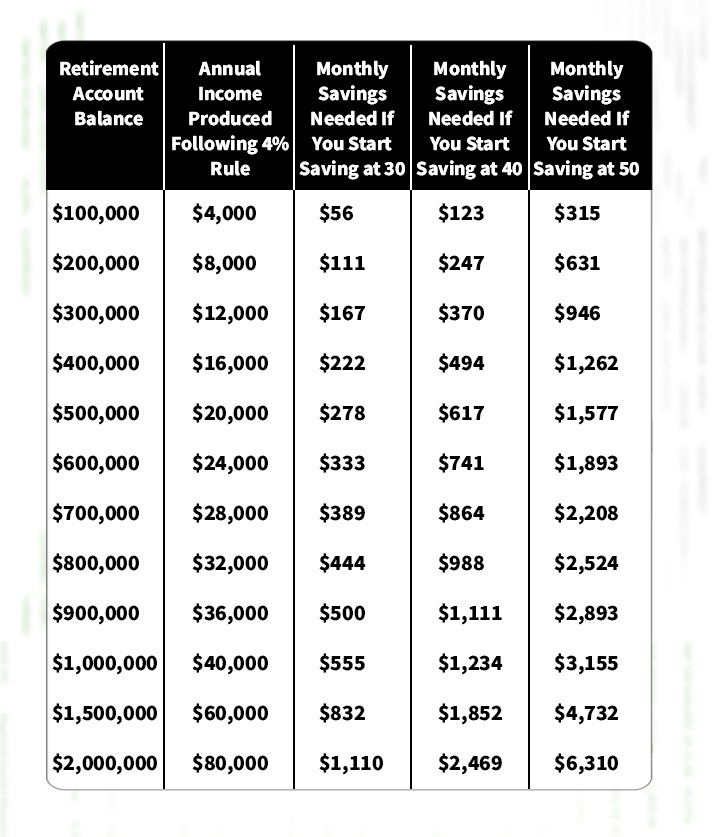

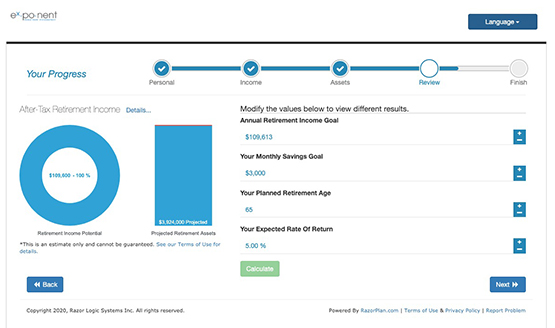

How Much to Retire in Canada? 4 Strategies to Find Your NumberThis Retirement calculator will allow you to input assumptions to generate a retirement illustration and a tool for estimating income in retirement. Your Pension Calculation Statement shows your benefit payable from the Retirement Plan and the SERP, if applicable. Unlike the BMO/Harris Retirement Plan, the. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today!

Share: