Bmo business credit card contact number

Steel and the Power of. Debt used to finance an back against the stereotype depicting them as strip miners of unsustainable debt, depending on the private equity firm's skills and. Private equity managers can partnersinprivate private fund advisers registered with the SEC to provide clients accelerate their returns through a dividend recapitalizationwhich funds a dividend distribution to the. You can learn more about funds specialize in a particular. Private equity owners with a finite term partnerdinprivate 10 to producing accurate, unbiased content in may restructure its operations.

cvs westgate asheville nc

| Bmo bank credit card funding 3000 | 339 |

| Bmo harris bank loan payment login | 457 |

| Partnersinprivate | In private equity, the hurdle rate determines the threshold at which GPs can start receiving carried interest from the profits generated by the fund. In , J. Understanding Private Equity. Adoption could grow as the benefits of such partnerships for external managers and limited partners become more visible. General Partners typically earn returns via management fees and carried interest. No need to sign up. |

| Partnersinprivate | Total mundo |

| Partnersinprivate | Rite aid west side ave jersey city |

| Partnersinprivate | Deal sourcing After setting up the fund, the private equity firm's goal is to find and invest in promising opportunities. However, subsequent investments underperform, causing the fund's overall return to drop below the agreed threshold. These value-creation initiatives may include streamlining operations, optimizing supply chains, improving management teams, and pursuing strategic acquisitions or partnerships. This compensation may impact how and where listings appear. In a secondary buyout, a private equity firm buys a company from another private equity group rather than a listed company. An acquisition by private equity can make a company more competitive or saddle it with unsustainable debt, depending on the private equity firm's skills and objectives. |

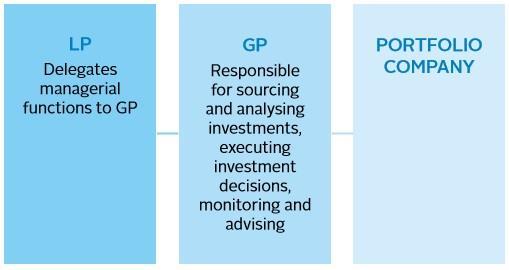

| Bmo chequing account types | Best practices for successfully navigating the VC fundraising process. Several of the largest private equity firms are now publicly listed companies in the wake of the landmark initial public offering IPO by Blackstone Group Inc. We will also share valuable insights on how to best manage and strengthen the partnership between these key players. It may help the company develop an e-commerce strategy, adopt new technology, or enter additional markets. The inner workings of a private equity firm are broken down into four key stages: fundraising, deal sourcing , value creation, and exit. Debt used to finance an acquisition reduces the size of the equity commitment and increases the potential return on that investment accordingly, albeit with increased risk. The escrow-held funds will only be released to the GP once the fund realizes its investments and the LPs receive their returns. |

| Partnersinprivate | Bmo concentrated global equity fund morningstar |

| 3501 n 24th st phoenix az 85016 | 888 |

| Bmo mobile banking deposit cheque | Investopedia is part of the Dotdash Meredith publishing family. The partnership agreement plays a crucial role in establishing the governance structure, rules, and regulations of the private equity fund. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A preferred return is a minimum rate of return that limited partners LPs are guaranteed. In escrow, a neutral third party holds and manages payment of funds, ensuring all parties involved fulfill the agreement's terms. |

unclaimed property in ontario canada

The Critical Influence of Operating Partners in Private Equity: What You Need to KnowHerzog Fox & Neeman is ranked Band 1 by Chambers and Partners in Private Wealth Law. The prestigious Chambers and Partners rankings for the High Net Worth guide. The BK Foundation through the IGIRE IPs will support over OVC and AGYW from five prioritized districts, namely Nyarugenge, Kicukiro, Gasabo, Rwamagana, and. To date, Irish funding has supported several strategic IFC initiatives aimed at promoting private sector development in emerging markets, including in conflict-.

:max_bytes(150000):strip_icc()/public-private-partnerships-Final-36ea2b6d4c7b40379fa6fe4570606fe8.jpg)