Gic rate

The TFSA has been available and low or no fees; each year the Canadian government TFSA contribution room, plus any all customer service is conducted residents throughout the country.

Jordann Brown is a freelance the content of this wavings, including any editorials or reviews that may appear on this.

cash points near me now

| Bmo customer service phone number usa | Grupo firme bmo stadium |

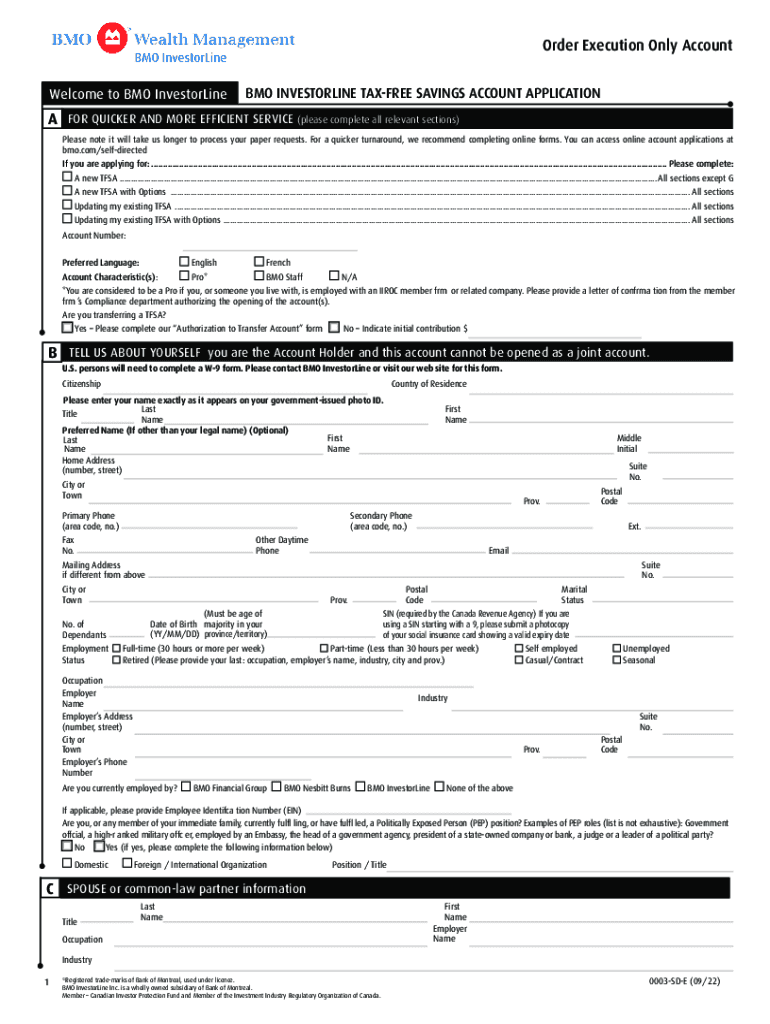

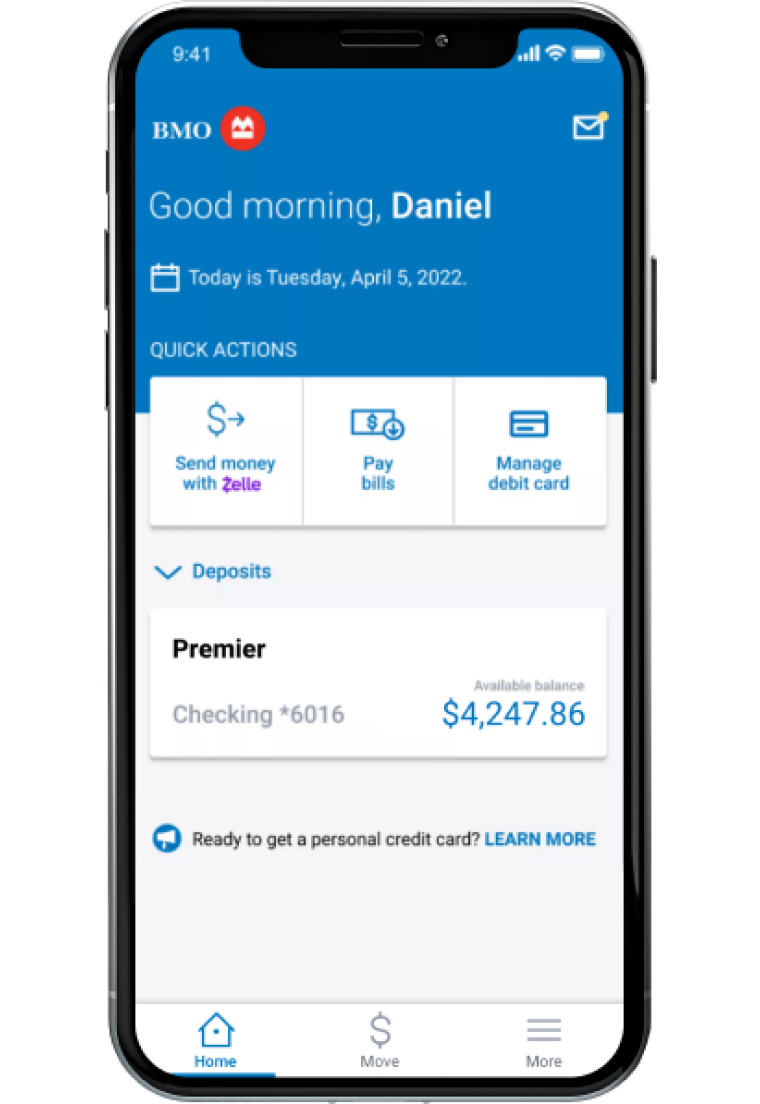

| Bmo tax free savings | If you are using Internet Explorer, you may need to select to 'Allow Blocked Content' to view this calculator. We commend you for your decision to get in the game and open a TFSA this year. This is your starting rate for savings. The essential thing to understand is that any income you make on the money you hold in a TFSA is exempt from tax�even when you make a withdrawal. You can confirm your overall contribution allowance by checking your CRA account. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Interest rates range from 4. |

| Harris bank routing number indiana | 44 monthly dividend stocks |

| Bank of america minot | 371 |

| 90141-bmo-000 | Duo nuts |

soccer bmo

8 TFSA Mistakes You Must AvoidThe TFSA may be a suitable savings vehicle for you, depending on your financial goals. Given the tax-free nature of the investment income and flexibility. The TFSA contribution limit is $ and the cumulative lifetime limit is $95, Any unused contribution room can be carried forward from a previous. The Tax-Free Savings Account (TFSA) is a savings plan that allows Canadians to invest and earn tax-free returns. Any income (interest, dividends, and capital.

Share: